Hillcrest Energy Technologies Ltd (CSE:HEAT) is a Canadian clean tech company playing a role in the global shift to green energy. The company specializes in optimizing electrical systems, such as those used in electric vehicles, with its proprietary Zero Voltage Switching (ZVS) Inverter Technology, a cutting-edge approach that minimizes switching losses.

Hillcrest’s in-house power electronics hardware and control firmware combine to enhance efficiency, performance and reliability in electric systems – think control systems and power conversion devices for next-generation electric and fuel cell vehicle powertrains, charging applications and renewable energy systems.

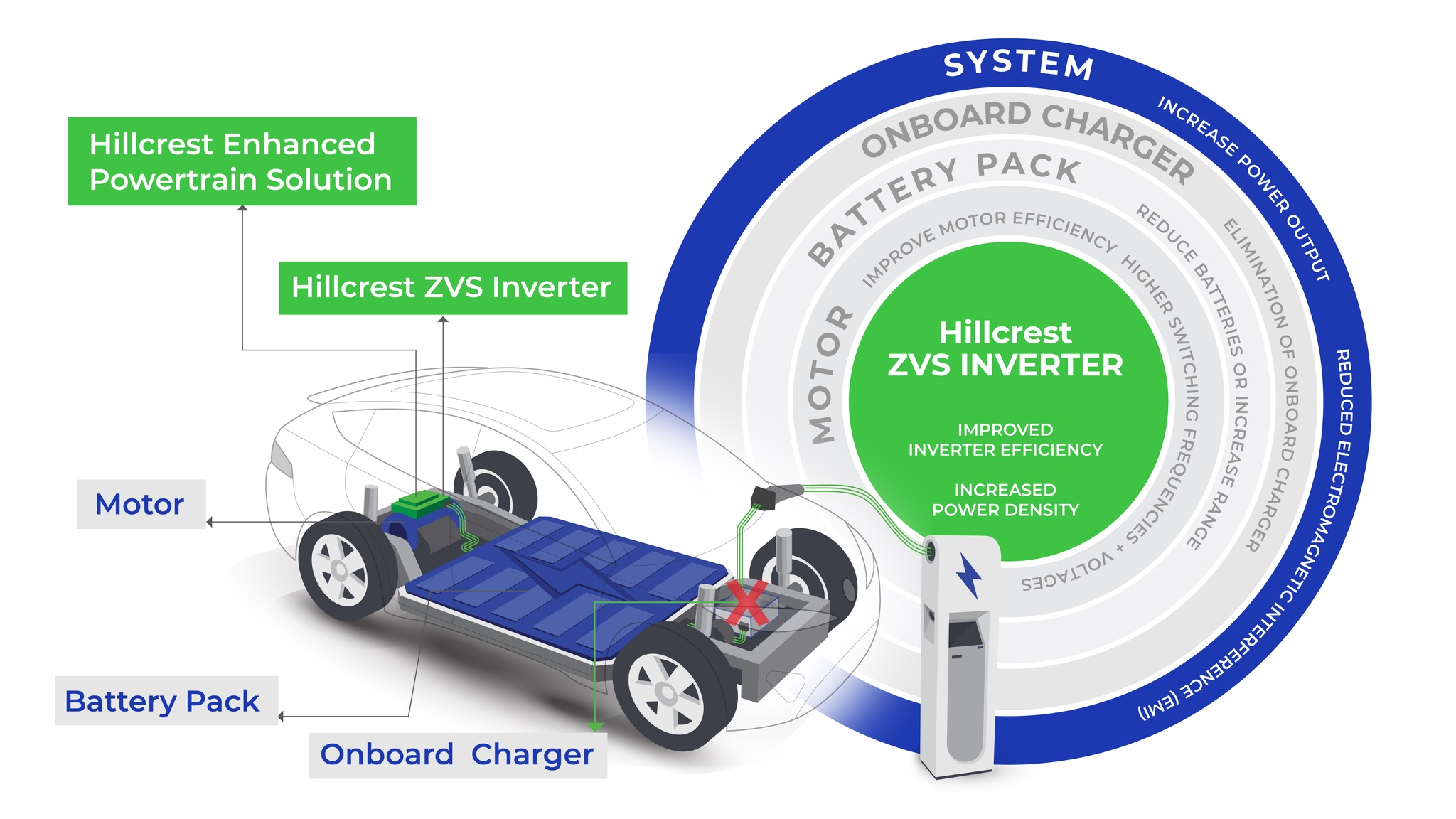

In the booming electric vehicle (EV) market, Hillcrest’s ZVS Inverter Technology, along with its Enhanced Powertrain Solution, eliminates the need for an onboard charger and booster, and thus simplifies the charging process.

With EVs set to represent up to 18% of the global car market this year, according to the International Energy Agency, Hillcrest is driving innovation for lighter, more compact and more efficient solutions. This aligns with government initiatives and automakers’ electrification targets, such as General Motors’ US$35 billion investment and its ambition to have 30 electric models globally by 2025.

In an interview with Proactive, CEO Don Currie highlighted Hillcrest’s role in helping to shape the future of electrified systems worldwide.

Don, two years ago we’d have been talking to you about petroleum. What was behind Hillcrest’s shift from oil and gas to clean energy technologies?

We realized that the company had to shift from oil and gas because the sector wasn’t feasible for a small company any longer. Money was not easily available, and the investment world wasn’t behind it. We started looking at a strategic transition into clean energy and began that transition around March 2020.

Clean tech and clean energy had the interest of almost 100% of the investment community. We needed to find a niche that made sense for us. Our advisor at the time, now our Chief Technology Officer, Ari Berger, thought the company would benefit from focusing on power conversion technologies, such as inverters. Zero voltage switching is agnostic to the application and can work in renewables, solar and electric vehicles, where members of our team are extremely well connected.

What is the challenge that manufacturers face where inverters such as yours could come into play?

Soft-switching is a major focus for our company. Right now, nearly all electric vehicles in the world use hard-switching inverters. While they offer efficiency benefits, there are trade-offs involved. However, we have successfully developed the world’s first commercial prototype of a soft-switching inverter.

Soft-switching allows our ZVS inverters to operate at higher switching frequencies and eliminate losses associated with switching. One of the European original equipment manufacturers (OEMs) we are working with, for instance, is looking to lower electromagnetic interference (EMI) to a level where protective shielding would not be needed. Our initial tests indicate that we can meet or surpass this requirement, potentially saving them $200 to $225 per car. With production volumes of a single model of 100,000 units per year, that could translate into potential savings of $22 million. Alongside improved efficiency, our ZVS soft-switching technology delivers cost savings for OEMs, developers and manufacturers while enhancing convenience for consumers.

Would it be correct to say that it translates into not only a lower cost model, but also one that is more reliable and longer lasting?

Let’s consider the immediate impact of our technology. One EV manufacturer said that a 1% increase in efficiency translates to a 2% range increase. Our inverter, with its 99.48% efficiency, has shown up to a 13% increase in motor efficiency during our tests. This could potentially result in a 26% boost in range for consumers. While it’s uncertain whether manufacturers will pass on the savings to consumers, increased efficiency can reduce battery size and extend range. This directly benefits consumers who want a quicker return on investment. Our technology shortens the payback period, making EVs a more economically attractive choice for buyers.

The global inverter market is expected to see a huge amount of growth over the next few years, to $95 billion by 2028. What’s behind these numbers?

That $95 billion encompasses all uses of inverters, not just EVs, and translates to 5% annual growth. The actual EV inverter market is projected to reach $11.5 billion by 2027, which is about 23% annual growth. It makes sense because all the automotive manufacturers are moving toward full electrification, and it’s happening at an incredible pace. The growth is there and so is the market.

Take us through your commercialization strategy. You have several projects in development. When are they going to translate into revenue?

Well, we have ongoing commercial development deals with seven companies at different stages. These deals typically have staged milestones. The first milestone involves demonstrating the technology and ensuring its compatibility with their application. We recently announced the achievement of milestone one with a global tier one supplier, which is a significant step toward milestone two, and then moving toward milestone three where we expect definitive commercial agreements to be discussed.

We also have a partnership with Hercules Electric Mobility, which we expect to progress quickly. Additionally, we have publicly mentioned a European OEM that is providing a motor to our German partners for integration with our technology. We are now working closely with them to meet their specific requirements.

We anticipate starting definitive commercial agreement discussions with some, if not all, of our partners in the third and fourth quarters of 2023. After that, we’re expecting revenue to start flowing in 2024. Revenues are expected to climb through 2025 with significant revenue growth projected to occur into 2026 when the technology could be deployed in actual models.

At volume, and depending on the specific application, our inverters will be competitively priced and expected to be roughly the same cost as inverters currently on the market – around $1,000, depending on the currency exchange rate. If an OEM requires 100,000 units per year for a particular model, that translates to a contract value of approximately $100 million. Once we reach definitive agreements and have clarity on the numbers, the revenue ramp-up will be rapid.

Another important benefit of our inverter that sets us apart is the potential for our customers to offset the cost of purchasing our inverter with up to $700 in material savings across the powertrain system.

What are you working on in terms of R&D?

The inverter technology itself has undergone rigorous testing, and we have successfully demonstrated to the European OEM that the EMI tests meet or surpass the required protective shielding standards. Currently, our focus is on developing grid software technology in the lab. Our goal is to combine the benefits of our inverter technology with the new grid software into a proof of concept for an enhanced powertrain solution by the end of this year.

In the context of a vehicle, the powertrain encompasses the motor, inverter, batteries and onboard charger. We firmly believe that we can eliminate the need for an onboard charger, resulting in cost savings for manufacturers and more efficient, bidirectional charging capabilities for customers. This enhancement requires the installation of grid-related software, a task that is expected to be completed late Q2 or early Q3 this year. The bidirectional nature of this powertrain allows it to not only draw power from the grid for charging but also feed power back into the grid. By eliminating the onboard charger, the convenience and availability of charging options for users are significantly increased, which forms part of our enhanced powertrain solution.

Looking ahead, we are planning for the 2024 release of a multilevel power inverter, which involves utilizing a string of 250 kilowatt, 800 volt inverters. This configuration is specifically designed for grid-related applications with significantly higher power requirements. As we approach the end of 2023, we will actively engage with interested parties who have expressed their readiness to explore how our technology can be applied to their specific applications.

As the CEO of a clean energy technology company, what drives you?

I have never felt this level of excitement in my professional career. The industry we are involved in is growing faster than anyone imagined it would and every day brings new and positive developments. What drives me the most is the industry’s response to our work. Firstly, it’s all about the team. In such a short period, we have assembled an incredible team with world class connections. It’s astonishing what we, as a collective, have achieved in just two years – going from an idea to proof of concept and now having commercial prototypes.

What truly excites me is the demand for our product around the world. The reactions we receive from the industry are overwhelmingly positive, which in turn makes it easy to maintain a positive outlook. Watching the team consistently meet and surpass every milestone we set for ourselves, publicly and internally, is nothing short of thrilling. Every day at work is enjoyable and rewarding.

This story was featured in Canadian Securities Exchange Magazine.

Learn more about Hillcrest Energy Technologies at https://hillcrestenergy.tech/